7 days a week, 24 hours, always working for you.

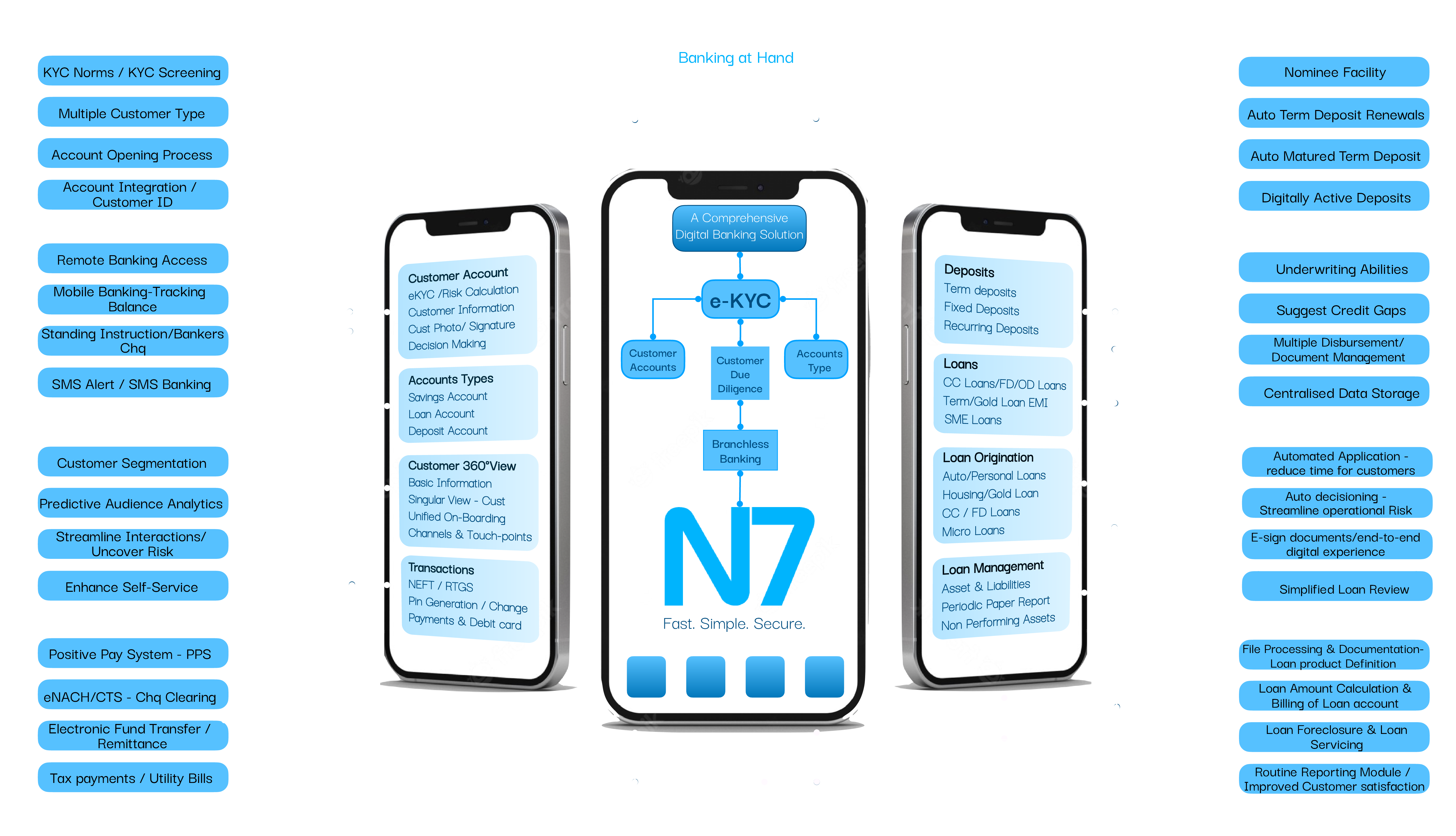

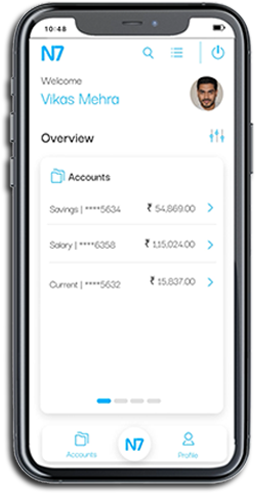

N7 provides seamless solutions for digital-only banking.

Digital banking out-of-the-box

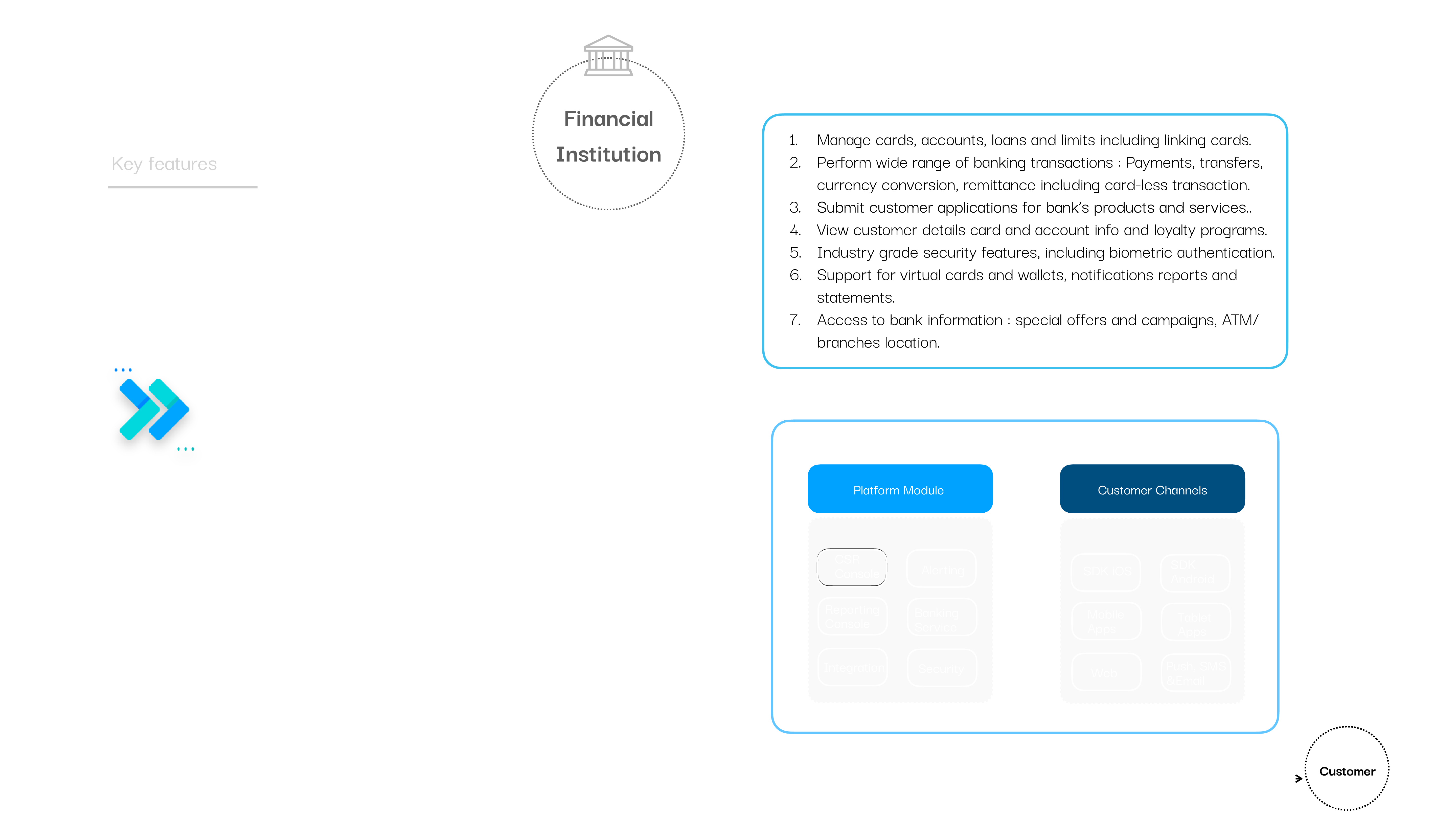

The complete digital banking solution N7 is at your finger tips, integrated with a fully-fledged CB7 that can contribute efficient, consistent and reliable functionality for the Financial Institution of all sizes.

FULLY COMPLIANT WITH REGULATORY REQUIREMENT

SECURITY

NO LEGACY IT SYSTEMS

HIGHLY EFFICIENT

CLOUD BASED

NO TRADITIONAL BRANCHES

AI-DRIVE SOLUTION

SECURITY

NO LEGACY IT SYSTEMS

HIGHLY EFFICIENT

CLOUD BASED

NO TRADITIONAL BRANCHES

AI-DRIVE SOLUTION

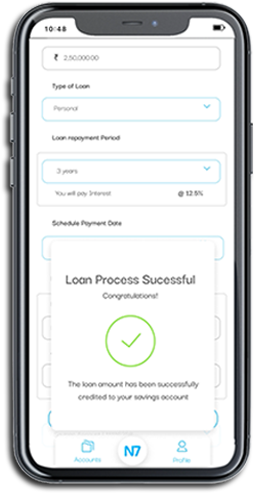

SIMPLE

FLEXIBLE

The componentized nature of our products enables clients to react and transform to market demands. Products built with Focus on user experience and a customer-centric approach.

OPEN

From the very inception, Our product suite is created using web technologies and open source system that helps constantly changing, often disruptive techno-financial environment.

Building the future of Next Generation Banking

N7 brings full capabilities across strategy, human-centred design, operations, engineering and data science to create and deliver disruptive innovation. Our approach to building digital banks is specifically designed to help clients drive new areas of growth, creating a flexible, data-centric platform, connecting to a rich ecosystem to deliver rapid value.

N7 is the platform for business transformation that helps financial institution to accelarate their digital transformation initiatives, bringing world-class transactional capabilities. N7 focuses on customer engagement through both digital and physical channels creating a seamless experience.

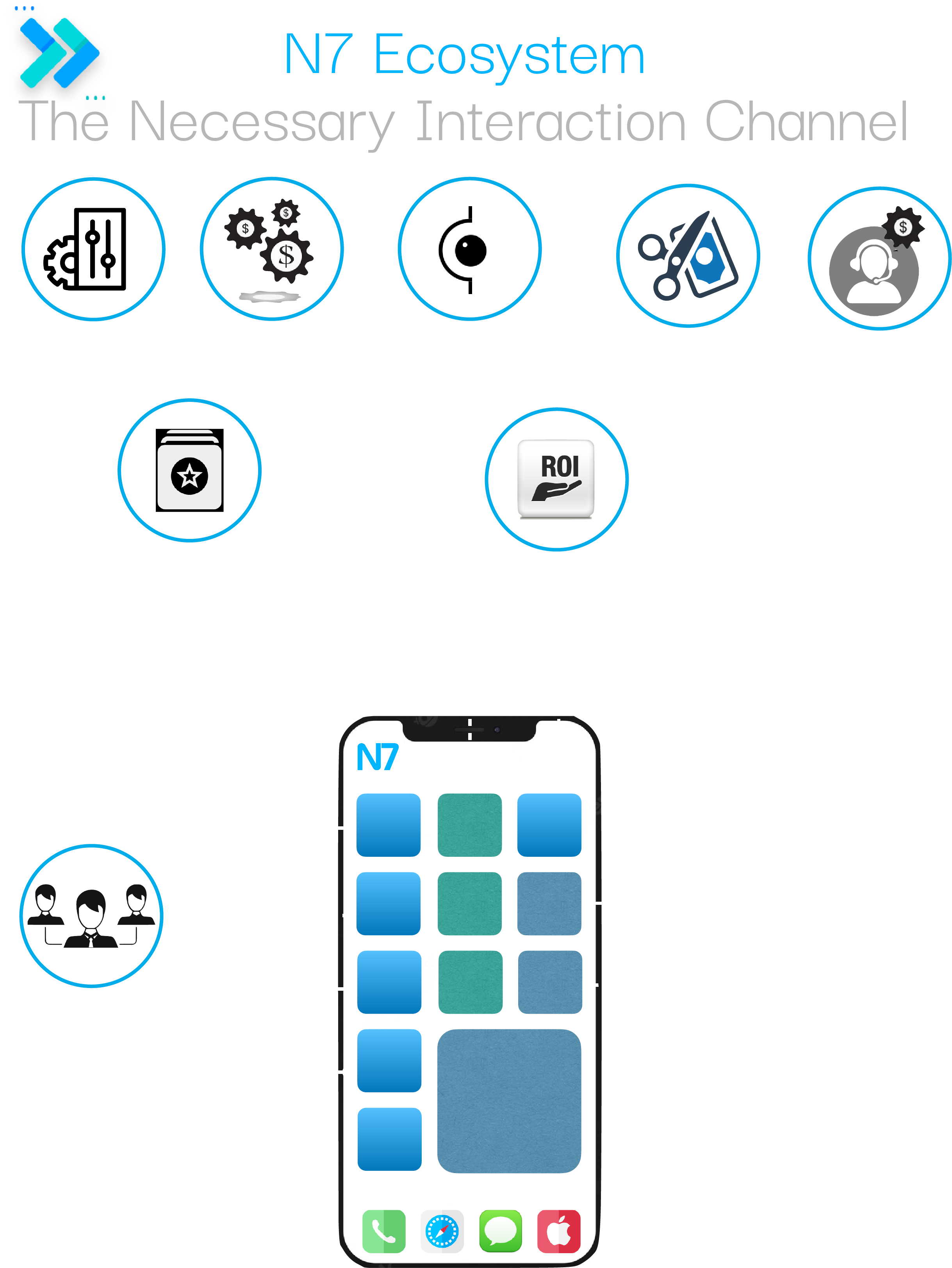

Digital Banking Ecosystem

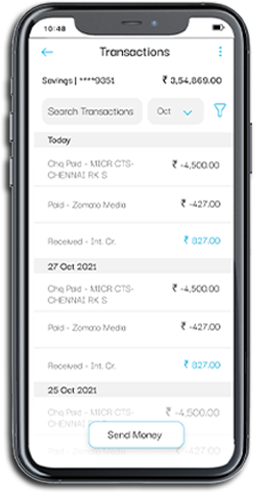

Consumer expectations are shifting in more ways than one.

N7 Digital Platform not only provide customers with the tools they want to communicate with their bank, providing institutions with tangible benefits. Our digital platform allows the bank to provide services via digital channels, decreasing the requirement for physical branches.

Digital platform allows customers to execute simple activities, lowering operational costs and allowing banks to focus their complex and advisory tasks, enforcing customer relationships and improving cross-selling opportunities.

Above and beyond – unrivalled client understanding

Customers can communicate with their bank through N7, which leaves a wealth of information about the products they use and the information they seek. Digital banking gives a bank the tools it needs to launch highly effective marketing campaigns and cross-sell to its existing customer base.

Our multi channel digital banking enable the bank to create targeted marketing messages to their various customer segments and achieve a short time-to-market for new products.