OUR FOCUS

Run a more efficient, flexible,

and digitally connected core

banking system

Our Solution

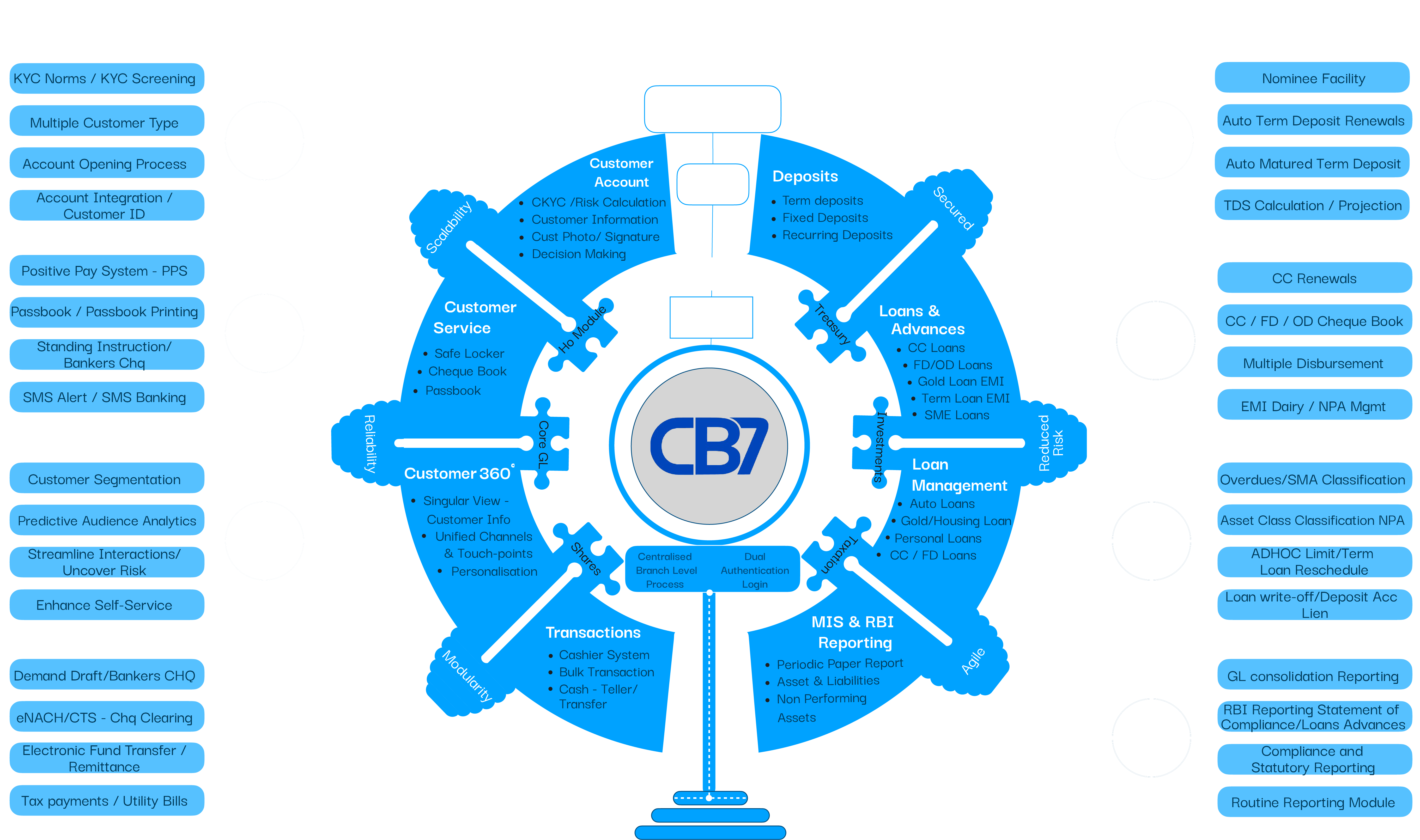

Our CB7 Core Banking solution helps your financial institution improve the client experience, automate and optimise procedures, simplify banking operations for your employees, improve risk management, increase productivity, and ensure full regulatory compliance.

The open-source cloud technology used to build the CB7 applications is adaptive and curated, with a responsive and flexible design. One of the key drivers for the software is a 360-degree client-centric approach, which enables AI-driven models for cross-sell opportunities as well as improved risk management practises.

- Customer-On Boarding

- Managing deposits and withdrawals

- Transaction management

- Interest Calculation

- Payments processing (cash, cheques, mandates, NEFT, RTGS etc)

- CRM Activities

- Configuring New Banking Products

- Loan disbursal and Loan management

- Account management

- Establishing criteria for minimum balances, interest rates, number of withdrawals allowed and so on.

- Customer-centric Architecture, Real-time 360-degree view of customer relationships.

- Banking finance including general ledger and reporting

- Provision of Login security, Module wise rights, Account rights, System locks

- Agile Solution, highly extensible through parameterization and user driven customization

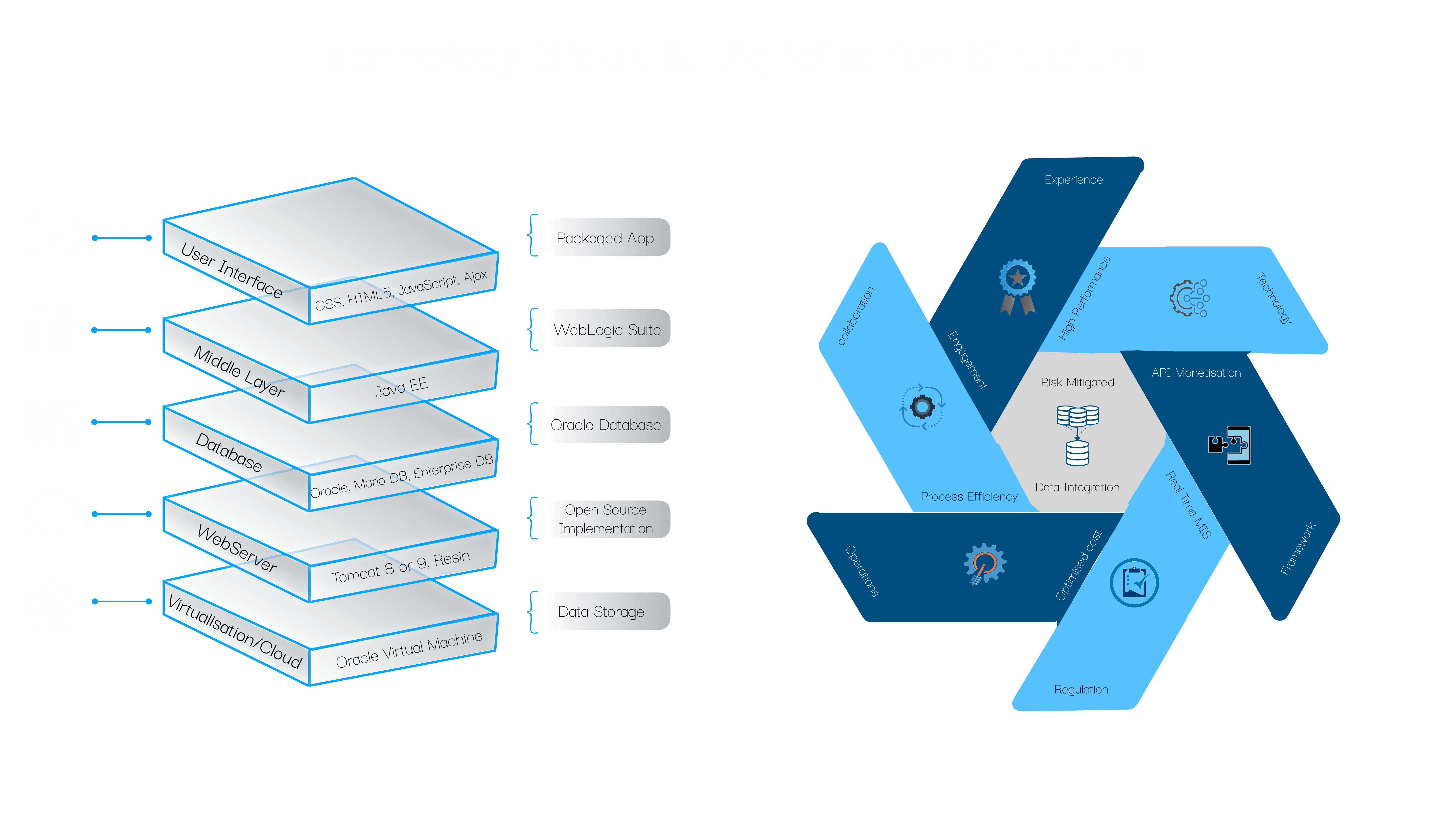

The front end is a client-side, this is the part of an app with which users interact directly. Our front-end is a combination of HTML, CSS, and JavaScript. HTML allows you to structure page elements, CSS is used to style the look and feel of a document created using HTML and JavaScript allows you to add dynamics to the user interface. To speed up the process our framework helps to create an effective application architecture.

ROI – A true N-tier Architecture and an integrated platform that provides an app and a browser experience and open source technologies , that lowering the overall TCO through for today’s being upgraded consumers.

Automation – Standardised and simple process with high levels of Automation and enhanced efficiency

Performance – High performance and scalability Flexibility and high level of configurability supporting a variety of Banking Models from the same solutions

Integration – Easy of Integration with in-built service integration capabilities

Customer Centric – Real time 360 degree view of customer relations within all branches

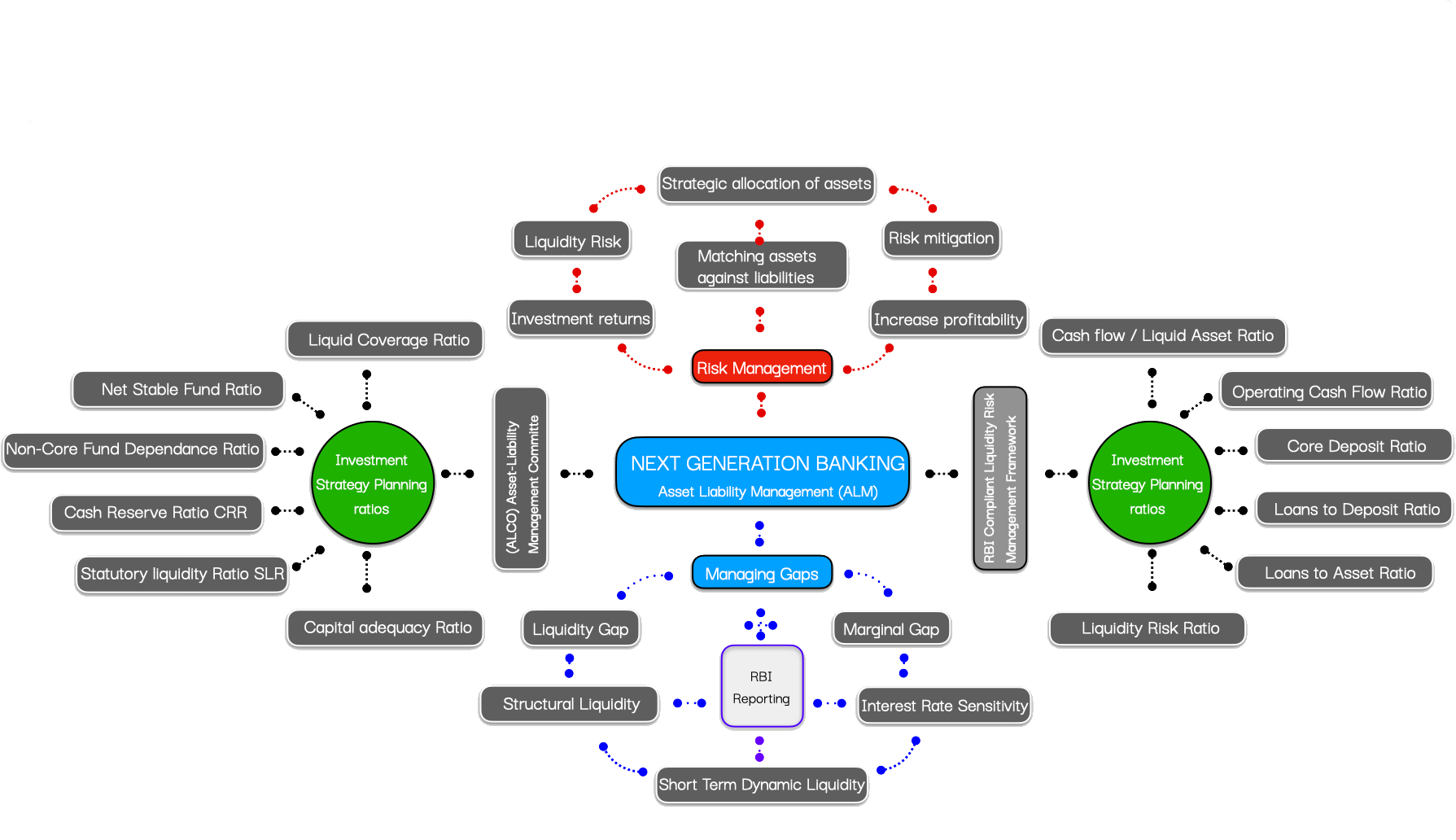

Our Asset Liability Management is an on-going process of formulating, implementing, monitoring, and revising strategies related to assets and liabilities in an attempt to achieve financial objectives for a given set of risk tolerances and constraints”. Asset and liability management (ALM) is a practice to mitigate financial risks resulting from a mismatch of assets and liabilities. We help financial institutions to manage liquidity, interest and currency risks within the regulatory and the bank’s own ALM limits, We help to ensure that the respective financial institutions to maintain sufficient capital buffers as per regulatory requirements. We are compliant with the RBI that had constituted a strong Management Formation System (MIS) for the NBFC & Co-op banks.

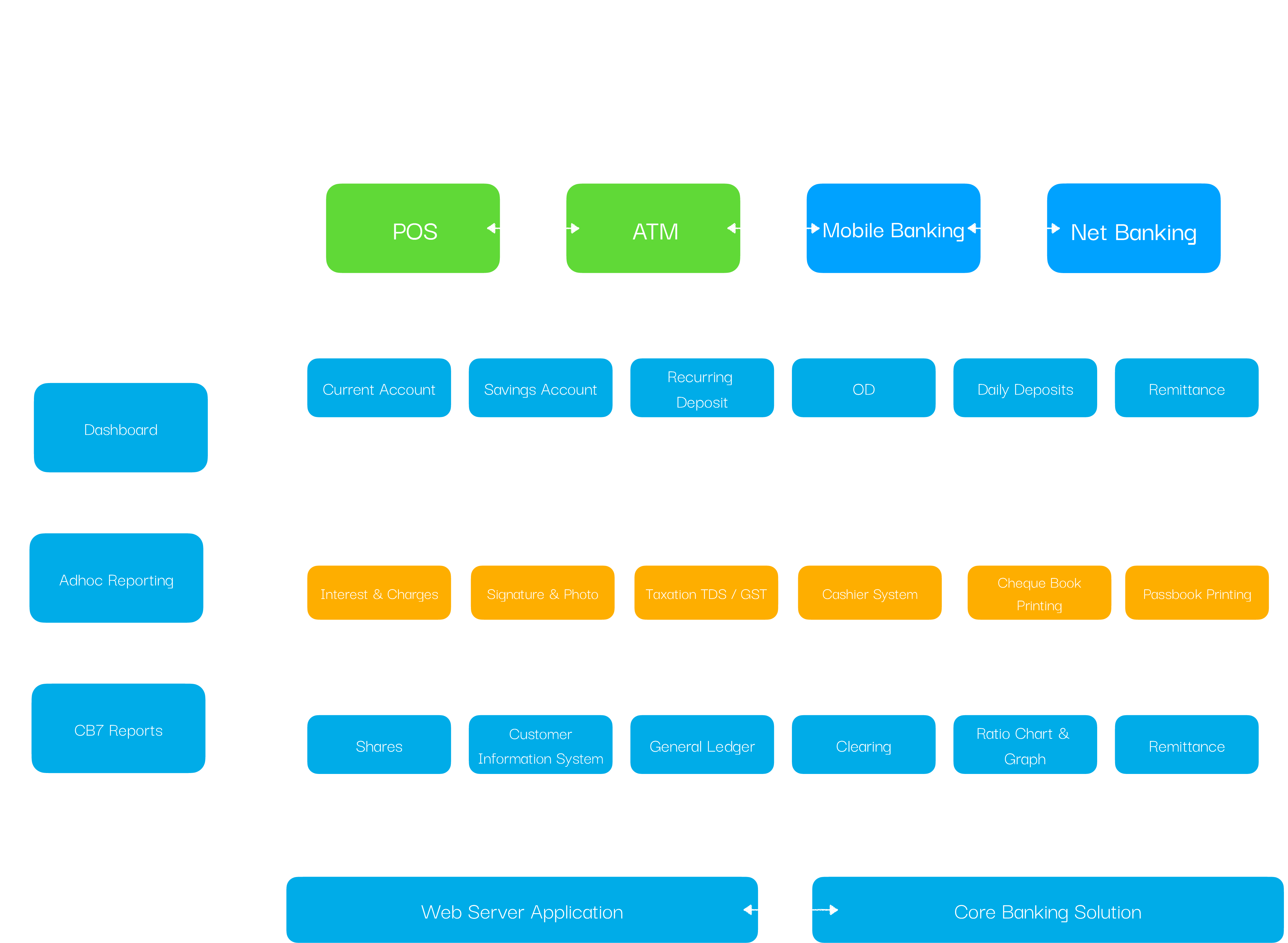

Our Screen-related Experience